Are you a short-term rental investor or high-income earner looking to significantly reduce your tax burden? Then Short-Term Rental Tax Secrets by CPAs Brandon Hall and Thomas Castelli is your essential guide. This book unveils strategies to save five to six figures annually, leveraging little-known tax regulations to maximize deductions. Learn how the US tax system works against W-2 earners and business owners, and discover how to utilize the "STR loophole" to minimize your tax liability. Master cost segregation, bonus depreciation, and material participation to optimize your savings. Don't miss this opportunity to build Tax Smart wealth – stop overpaying taxes and start keeping more of your hard-earned money today.

Review Short-Term Rental Tax Secrets

I found "Short-Term Rental Tax Secrets" to be a surprisingly engaging and informative read, even for someone who doesn't typically gravitate towards tax books. While I share the authors' frustration with the often-misleading term "loophole," the book effectively demystifies the complexities of short-term rental taxation. It's clear that Brandon Hall and Thomas Castelli, with their extensive experience, have crafted a guide that's both comprehensive and accessible.

What initially drew me in was the straightforward, friendly tone. The authors avoid overly technical jargon, explaining complex tax concepts in a way that’s easy to understand, regardless of your accounting background. This is particularly valuable for those new to real estate investing or even seasoned investors who might need a refresher on the intricacies of STR tax strategies. The book’s structure is well-organized, allowing readers to easily navigate the information and find answers to specific questions. The inclusion of a handy FAQ section (Chapter 10, as mentioned by one reviewer) further enhances its practicality. It's the kind of book you can dip in and out of, referencing specific sections as needed.

The content itself is incredibly thorough. It goes beyond simply outlining deductions; it explains why certain strategies work, referencing relevant court cases to bolster its claims and build reader confidence. This level of detail is crucial for understanding not just what to do, but why it’s important. The book convincingly demonstrates how leveraging specific aspects of the tax code can lead to substantial savings—potentially saving investors five or six figures. This is not just about finding quick wins; it's about building a sustainable, tax-smart approach to wealth creation.

Beyond the technical aspects, I appreciated the authors’ emphasis on proactive tax planning. They don't just present strategies; they highlight potential pitfalls and mistakes to avoid, saving readers from potentially costly errors. This preventative approach is invaluable, particularly given the ever-changing landscape of tax laws.

However, I must reiterate my concern about the use of "loophole." While the authors use it, I think it's important to emphasize that this isn't about exploiting a flaw in the system, but rather about strategically utilizing existing tax regulations to optimize one's financial position. It's about smart planning, not shady dealings. This subtle but important distinction is something readers should keep in mind.

In conclusion, "Short-Term Rental Tax Secrets" is a valuable resource for anyone involved in short-term rentals, whether as an investor, property manager, or tax professional. It's a well-written, well-structured, and informative guide that makes complex information readily digestible. While the "loophole" terminology is regrettable, the overall quality and usefulness of the book far outweigh this minor drawback. I highly recommend it as a go-to resource for understanding and maximizing tax advantages in the short-term rental market.

Information

- Dimensions: 6 x 0.23 x 9 inches

- Language: English

- Print length: 100

- Publication date: 2024

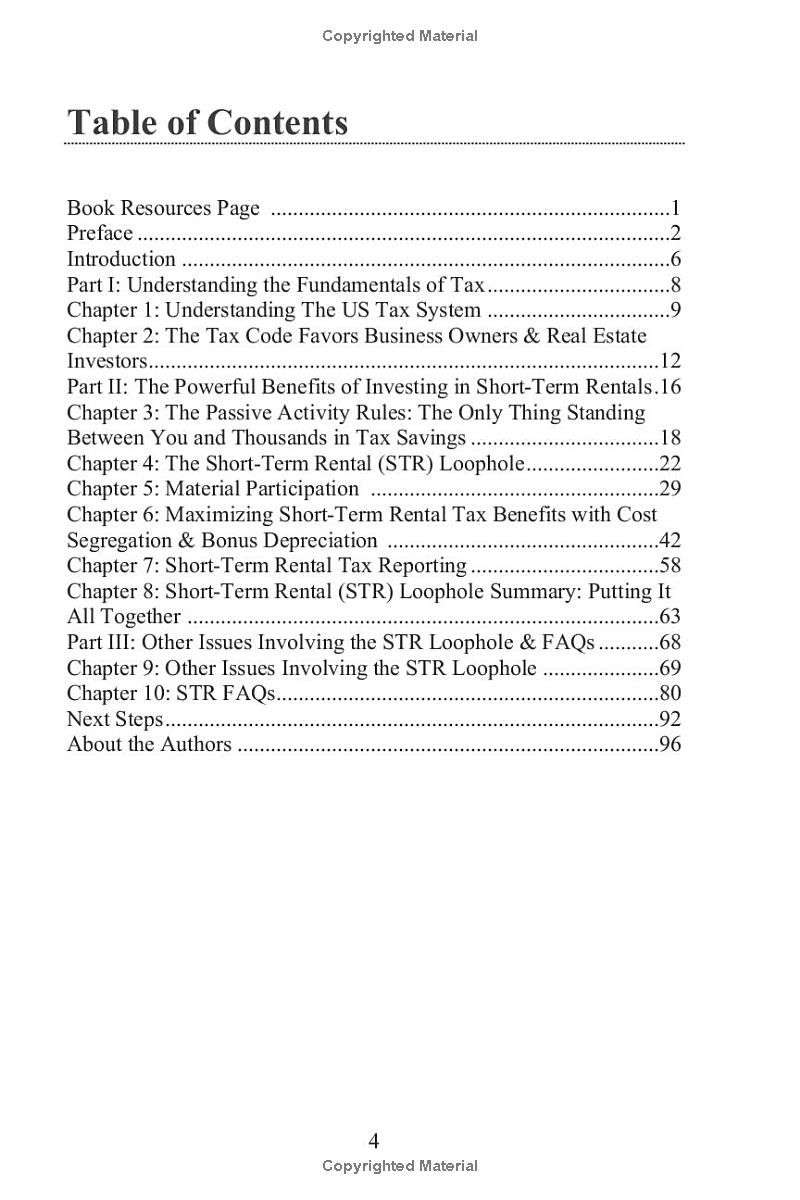

Book table of contents

- Part I: Understanding the Fundamentals of Tax

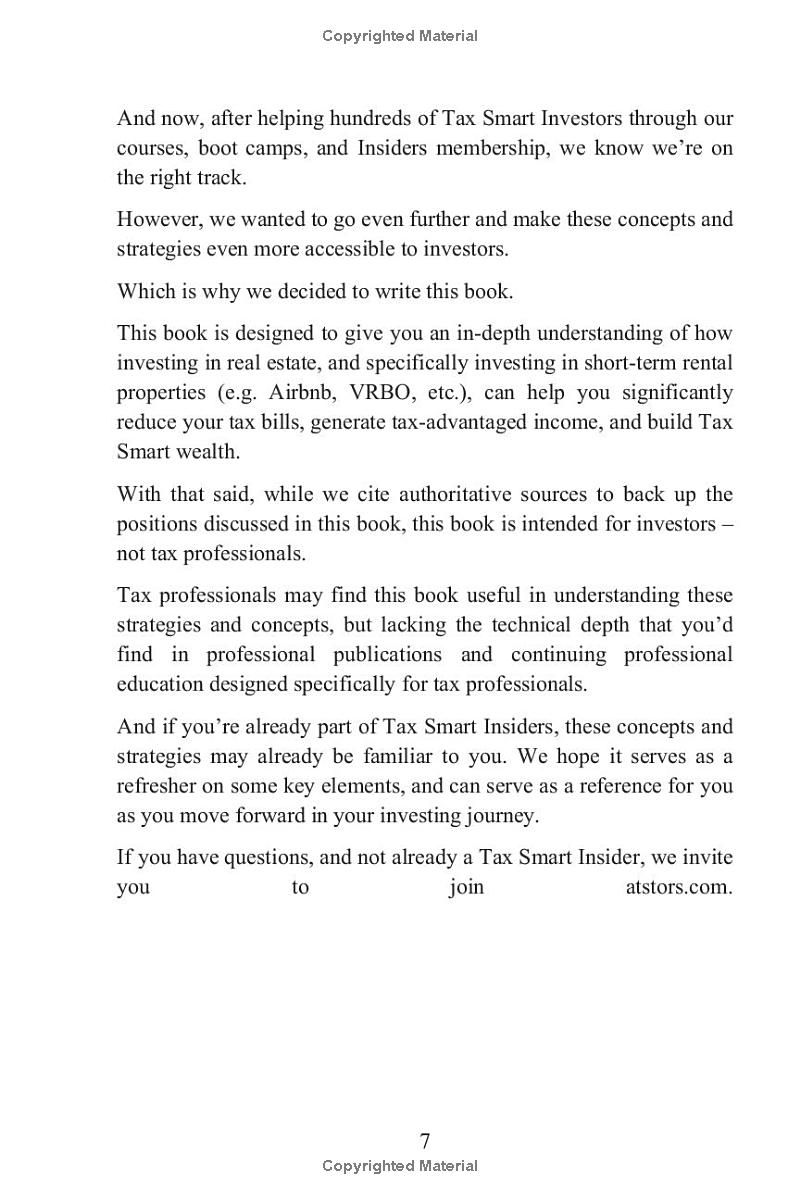

- Chapter 1: Understanding The US Tax System

- Chapter 2: The Tax Code Favors Business Owners & Real Estate Investors

- Part II: The Powerful Benefits of Investing in Short-Term Rentals

- Chapter 3: The Passive Activity Rules

- Chapter 4: The Short-Term Rental (STR) Loophole

- Chapter 5: Material Participation

- Chapter 6: Maximizing Short-Term Rental Tax Benefits with Cost Segregation & Bonus Depreciation

- Chapter 7: Short-Term Rental Tax Reporting

- Chapter 8: Short-Term Rental (STR) Loophole Summary: Putting It All Together

- Part III: Other Issues Involving te STR Loophole & FAQs

- Chapter 9: Other Issues Involving the STR Loophole

- Chapter 10: STR FAQs

- About the Authors

Preview Book